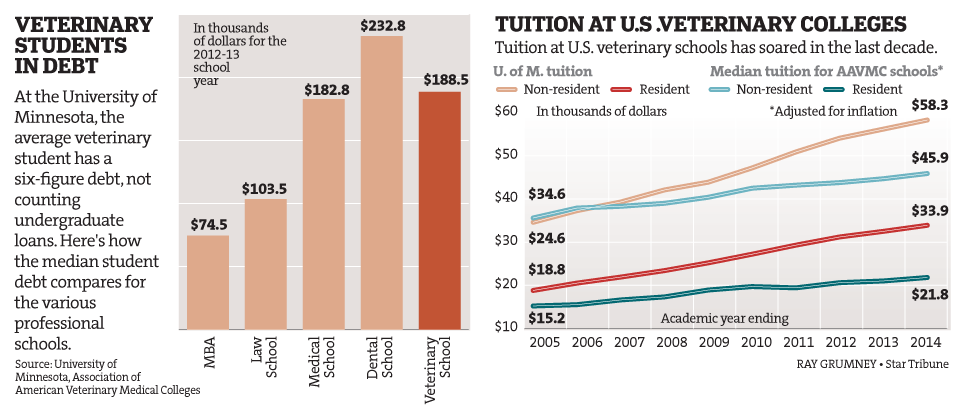

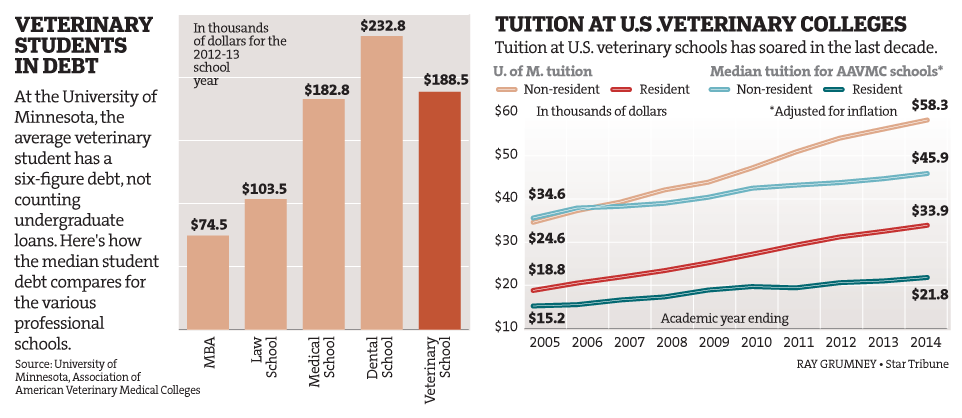

The cost of higher education has skyrocketed over the last 10 years. Many students do not have the resources to pay out-of-pocket for such costs and are required to take out student loans to pay for not only tuition but also the full cost of attendance. Student loans can occasionally total as much as $300,000 by graduation. However, for veterinarians, buying a veterinary practice can help you get out of debt sooner.

The initial question is whether the “debt-burdened veterinarian” has the option to buy a veterinary practice while in debt hundreds of thousands of dollars. We often hear, “I can’t buy a practice because I have a debt of hundreds of thousands of dollars and a negative net worth.” Nothing could be further from the truth.

When the transition industry began over 30 years ago, it was impossible to borrow money for the acquisition of a veterinary practice - regardless of whether the veterinarian had student debt or not. Veterinary practice sellers had to hold a note from the buyer for the purchase price and that note was financed over as much as 10 years at an agreed upon interest rate. The market for financing currently is 180° from the old days.

Under the right circumstances, banks will now loan a new graduate 100% of the purchase price to acquire a veterinary practice, 100% of the working capital needed to operate the business until cash flow will support it, and 100% of the money required to buy the real estate. In other words, a newly minted, debt ridden, graduate does not need a penny of net worth in order to buy a practice.

Logic would tell you that banks are less likely to make large loans to someone with large debt. Thus, the new buyer would need to seek out a smaller practice that would cost less and require a smaller loan from the bank. That would be a misconception. Banks care more about whether the buyer can replicate current production than the size of the practice. Actually, the bank is more likely to loan money to acquire a larger practice than a smaller one. The bank needs the buyer to acquire a large enough practice that will generate enough profit to repay the bank and student loans while still having enough money left to live on. Buyers must asses their current debt level and decide how big of a practice is necessary in order to meet all of their obligations. The larger the loan, the larger and more profitable the practice acquired will need to be.

You can borrow to buy but should you? You already have huge debts. Should you go even further into debt or wait and pay off your debt before acquiring a practice and adding even more debt? There are two kinds of debt – good debt and bad debt. Bad debt is a Porsche. It feels great when you look at it but it declines in value. It is a depreciating asset that generates no income. Depreciating assets that generate no income are bad investments and you should not go into debt to acquire such an asset. Assets that appreciate in value and generate income are exactly the opposite. One such asset is a veterinary practice. A veterinary practice generates income and, with the right management, should increase in value. Depending on your risk tolerance, you should avoid bad debt but embrace the idea of good debt.

As an associate veterinarian you will make approximately $60,000-$100,000 a year depending upon your level of experience. Owners of veterinary practices earn approximately $285,000 per year or 3 ½ times the earnings of an associate. If after buying and paying for a practice you were left with $185,000 per year ($285,000-$100,000 debt service on practice acquisition), it would take you 2.5 years to pay off $300,000 of student debt. If you remain an associate and need $50,000 per year to live on, other than your student loan payment, it would take you 10 years to pay off a $300,000 student loan. In this case, it is obviously much smarter to buy a practice even though it requires going into more debt to do so. The acquisition of an income-generating asset allows you to not only improve the quality of your life much sooner but also build equity for the future. After paying off the practice, you will have an asset that you can one day sell to fund an even better quality of life.

There is an old saying: when you find yourself in a hole stop digging. Like almost everything there are exceptions to every rule. When you find yourself in a student loan hole, sometimes the smartest thing to do is keep digging by leveraging your education to acquire an income generating asset that will lift you out of that hole much faster.

Street Address:

100 Crescent Ct, Suite 700

Dallas, TX 75201

Call Us: 214.593.7158

Email: mlee@praxisinc.com

No Comments Yet

Let us know what you think